Forex trading on the Pocket Option platform provides traders with an opportunity to engage in the world’s largest financial market, with features designed to make currency trading accessible, efficient, and potentially profitable.

Does Pocket Option Offer Forex Trading?

Overview:

Yes, Pocket Option supports Forex trading as part of its comprehensive range of trading options. The platform allows users to trade currency pairs with advanced tools and features designed to enhance the trading experience, whether you are a beginner or an experienced trader.

Available Currency Pairs:

- Major Pairs: These include popular and heavily-traded pairs like EUR/USD, USD/JPY, GBP/USD, and more.

- Minor Pairs: Comprising currency pairs that do not involve the US dollar but include major currencies like the euro, yen, or pound.

- Exotic Pairs: Combinations of major currencies with emerging market currencies, providing higher volatility and potential for significant price movements.

Forex Trading Features on Pocket Option:

Real-Time Market Data:

- Description: Traders have access to live price charts and real-time data feeds for all available currency pairs.

- Benefit: Enables quick decision-making and up-to-date market analysis.

Leverage Options:

- Description: Pocket Option offers leverage, allowing traders to control larger positions with smaller initial investments.

- Benefit: While leverage can amplify profits, it is crucial to use it carefully due to the risk of magnified losses.

Technical Analysis Tools:

- Description: The platform provides access to indicators like RSI (Relative Strength Index), moving averages, Bollinger Bands, and more.

- Benefit: Traders can conduct in-depth market analysis and identify potential entry and exit points.

Flexible Trade Sizes:

- Description: Users can customize their trade sizes to suit their risk tolerance and trading strategies.

- Benefit: Enables precise position sizing and effective risk management.

Social and Copy Trading:

- Description: Follow and copy successful traders on the platform.

- Benefit: Helps novice traders learn and potentially benefit from the experience of seasoned traders.

How to Start Forex Trading on Pocket Option?

Step-by-Step Guide:

Create an Account:

- Visit the Official Website: Go to Pocket Option or download the mobile app for convenience.

- Click on “Sign Up/Register”: This option is visible on the homepage.

- Enter Your Details: Provide your email address, create a secure password, and agree to the terms and conditions. Alternatively, you can register using Google or Facebook for a faster process.

- Verify Your Email: A verification link will be sent to your registered email. Click on the link to confirm your registration.

Complete the Verification Process (Optional but Recommended):

- Submit Identity Documents: Upload a government-issued ID (passport, driver’s license, or national ID).

- Provide Proof of Address: Upload a recent utility bill, bank statement, or similar document with your current address.

- Why It’s Important: Verified accounts have higher withdrawal limits and access to more features.

Make a Deposit:

- Minimum Deposit: The minimum deposit amount varies but typically starts at $10 or equivalent in your chosen currency.

- Deposit Methods: Choose from a range of payment options, such as credit/debit cards, e-wallets, cryptocurrencies, and bank transfers.

Access Forex Trading:

- Navigate to the Forex Section: After logging into your account, select the Forex trading option from the main menu.

- Choose a Currency Pair: Browse and select the currency pair you want to trade (e.g., EUR/USD, GBP/JPY, etc.).

Set Up a Trade:

- Select Trade Size and Leverage: Choose the amount you wish to trade and apply leverage if desired.

- Analyze the Market: Use available technical indicators, charts, and market news to inform your trade.

- Place a Trade: Enter a buy or sell position depending on your market analysis.

Monitor and Manage Your Trades:

- Use stop-loss and take-profit orders to manage risk.

- Keep an eye on your trade performance using the platform’s live charts and tools.

Tips for Forex Trading on Pocket Option:

- Start with a Demo Account: Practice with virtual funds before trading with real money.

- Use Risk Management: Always set stop-loss orders and avoid over-leveraging.

- Stay Informed: Keep up with market news and events that can impact currency movements.

By following these steps and utilizing Pocket Option’s tools, traders can engage in the forex market effectively and with confidence.

What Are the Benefits of Forex Trading on Pocket Option?

Key Benefits of Trading Forex on Pocket Option:

Leverage:

- Description: Pocket Option offers leverage options that allow traders to control larger positions with a smaller amount of invested capital.

- Benefit: Leverage can significantly amplify potential profits, making it easier for traders to enter and benefit from larger market movements with less capital. However, it is essential to manage risk carefully to avoid amplified losses.

Low Spreads:

- Description: The platform provides competitive spreads on various currency pairs, which refers to the difference between the bid and ask price.

- Benefit: Lower spreads reduce the cost of entering and exiting trades, making it more cost-effective for frequent and large-volume traders.

Wide Range of Currency Pairs:

- Description: Pocket Option offers a diverse selection of currency pairs, including major, minor, and exotic pairs.

- Benefit: This allows traders to diversify their trading portfolios and capitalize on different market trends and opportunities around the world.

User-Friendly Interface:

- Description: The Pocket Option platform is known for its intuitive and easy-to-navigate interface.

- Benefit: Beginners can quickly understand how to trade forex, while experienced traders can utilize advanced features efficiently.

Advanced Trading Tools:

- Description: The platform offers a variety of tools for technical analysis, including indicators, charts, and signals.

- Benefit: These tools help traders analyze market trends, predict price movements, and make informed decisions.

Real-Time Data and Charts:

- Description: Pocket Option provides real-time quotes and charts for all available forex pairs.

- Benefit: Traders can monitor price changes instantly and respond to market movements with speed and accuracy.

Demo Account for Practice:

- Description: New users can start with a demo account funded with virtual money to practice forex trading strategies.

- Benefit: This feature helps new traders gain confidence and test strategies without risking real money.

Social and Copy Trading:

- Description: Traders can follow and copy the trades of successful and experienced traders on the platform.

- Benefit: This feature allows beginners to learn from experts and potentially increase their success rate by leveraging others’ expertise.

Multiple Payment Options:

- Description: Pocket Option supports various deposit and withdrawal methods, including bank transfers, credit cards, e-wallets, and cryptocurrencies.

- Benefit: This flexibility makes it easier for users around the world to fund their accounts and access their profits.

What Currency Pairs Can I Trade on Pocket Option Forex?

Available Currency Pairs for Forex Trading:

Pocket Option offers a diverse range of currency pairs, categorized into major, minor, and exotic pairs. Here’s what each category typically includes and what you can expect to find on the platform:

Major Pairs:

- Description: Major pairs involve the most traded currencies globally, always including the USD (United States Dollar).

- Examples:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

- Benefit: These pairs are highly liquid, have tight spreads, and are less volatile compared to other categories, making them ideal for new traders and those seeking stability.

Minor Pairs:

- Description: Minor pairs do not involve the USD but include major currencies like the Euro, Pound, or Yen.

- Examples:

- EUR/GBP (Euro/British Pound)

- AUD/JPY (Australian Dollar/Japanese Yen)

- GBP/JPY (British Pound/Japanese Yen)

- Benefit: These pairs tend to have lower liquidity than majors but offer more volatility, creating additional trading opportunities.

Exotic Pairs:

- Description: Exotic pairs involve one major currency paired with a currency from a smaller or emerging market economy.

- Examples:

- USD/TRY (US Dollar/Turkish Lira)

- EUR/SEK (Euro/Swedish Krona)

- USD/THB (US Dollar/Thai Baht)

- Benefit: Exotic pairs can offer higher volatility and potentially greater profits but typically come with higher spreads and less liquidity.

Explanation of Major, Minor, and Exotic Pairs:

- Major Pairs: Most frequently traded and have the highest liquidity, leading to lower spreads and reduced trading costs.

- Minor Pairs: Offer more volatility than majors, making them suitable for experienced traders looking to exploit larger price movements.

- Exotic Pairs: Can be riskier but offer potential for significant returns due to high volatility and price swings.

By offering this range of currency pairs, Pocket Option allows traders to diversify their strategies, explore different markets, and manage risk based on their trading preferences and expertise level.

How Does Leverage Work on Pocket Option Forex?

Understanding Leverage in Forex Trading:

Leverage is a tool that allows traders to control a larger position in the market with a smaller amount of their own capital. On Pocket Option, leverage can significantly amplify both potential profits and potential losses, making it an essential tool to understand and use wisely.

How Leverage Works:

Leverage Ratio:

- Description: Leverage is expressed as a ratio, such as 1:10 or 1:100. A 1:10 leverage means that for every $1 of your own money, you can control a $10 position.

- Example: If you open a trade worth $1,000 with a 1:100 leverage, you only need $10 of your own capital (also known as the margin) to control that position.

Benefits of Leverage:

- Increased Buying Power: Leverage allows you to trade larger positions than what your account balance would typically allow.

- Potential for Higher Profits: By controlling a larger position, even small movements in the forex market can lead to substantial profits.

- Access to More Trading Opportunities: With increased buying power, traders can diversify their trades and potentially capitalize on different market movements.

Risks of Leverage:

- Amplified Losses: Just as leverage can increase profits, it can also magnify losses if the market moves against your position.

- Margin Calls: If your trade moves significantly against you, your account balance may not be sufficient to cover the potential losses, resulting in a margin call or even account liquidation.

- Higher Volatility Risk: Leverage increases the potential impact of market volatility, making trades riskier.

Leverage Options on Pocket Option:

- Available Ratios: Pocket Option offers different leverage ratios, which can vary depending on the type of account, trading experience, and market conditions.

- Customizable Leverage: Experienced traders can adjust leverage to suit their risk tolerance and strategy. It’s recommended to start with lower leverage ratios if you are new to forex trading.

Practical Tips for Using Leverage:

- Start Small: Use a lower leverage ratio until you are comfortable with how it affects your trades.

- Set Stop-Loss Orders: This can help minimize losses if the market moves against you.

- Understand the Risks: Leverage is a double-edged sword; use it with caution and understand how it impacts your trades.

How to Manage Risk in Forex Trading on Pocket Option

Effective Risk Management Strategies:

Use Stop-Loss and Take-Profit Tools:

- Stop-Loss Orders: Automatically closes your trade when it reaches a predetermined loss level, limiting potential losses.

- Take-Profit Orders: Closes your trade when it reaches a set profit level, locking in gains.

- Benefit: These tools help you manage risk by defining the maximum loss or profit you are willing to accept on a trade.

Set a Risk-to-Reward Ratio:

- Description: Determine the amount you are willing to risk for a potential reward on each trade (e.g., risking $1 to gain $3).

- Tip: Stick to a consistent risk-to-reward ratio to ensure that your winning trades outweigh potential losses.

Limit the Use of Leverage:

- Description: Only use leverage that you can comfortably manage. Excessive leverage increases the risk of significant losses.

- Tip: Consider starting with low leverage and increasing it gradually as you gain experience and confidence.

Diversify Your Trades:

- Description: Spread your capital across different currency pairs or asset classes to reduce exposure to any single trade.

- Benefit: Diversification can reduce the overall risk of your trading portfolio.

Avoid Emotional Trading:

- Description: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Tip: Take breaks when needed and use trading tools like stop-loss orders to help maintain discipline.

Use the Demo Account:

- Description: Practice using risk management strategies on the Pocket Option demo account before trading with real money.

- Benefit: This allows you to test and refine your approach without risking your own capital.

Monitor Market News:

- Description: Stay informed about economic events, interest rate decisions, and geopolitical developments that can impact currency prices.

- Tip: Avoid trading during high-volatility events unless you have a clear strategy to manage the risks.

Risk Management Tools on Pocket Option:

- Stop-Loss and Take-Profit Orders: Essential for managing the risk of individual trades.

- Position Sizing Calculator: Helps determine the appropriate trade size based on your account balance and risk tolerance.

- Margin Requirements: Ensure you understand the margin needed for each leveraged trade and how it impacts your available funds.

By effectively managing risk and using leverage wisely, traders on Pocket Option can maximize their potential for success while minimizing the risks inherent in forex trading.

Is Pocket Option Good for Beginner Forex Traders?

Suitability for Beginner Forex Traders:

Pocket Option is considered a suitable platform for beginner forex traders due to its focus on user-friendly design, educational resources, and tools that cater to new users entering the complex world of forex trading.

Key Features for Beginners:

User-Friendly Interface:

- Description: The platform offers a clean and intuitive interface, which makes it easy for beginners to navigate and understand the basics of forex trading.

- Benefit: Unlike more complex platforms, Pocket Option simplifies trading, making it accessible for users with little to no experience.

Demo Account for Practice:

- Description: Pocket Option provides a demo account with virtual funds, allowing beginners to practice trading without risking real money.

- Benefit: The demo account serves as a risk-free environment where new traders can learn and test strategies before transitioning to live trading.

Educational Resources:

- Description: The platform offers a variety of educational materials, including tutorials, articles, webinars, and video guides.

- Benefit: These resources help beginners build a solid foundation in forex trading, covering topics such as technical analysis, market trends, and risk management.

Social and Copy Trading Features:

- Description: Pocket Option allows users to follow and copy the trades of experienced traders.

- Benefit: Beginners can learn from observing the strategies of successful traders, gaining insights into market behavior and effective trading techniques.

Low Minimum Trade Amounts:

- Description: The platform allows users to start trading with small trade sizes.

- Benefit: This minimizes risk and makes it easier for new traders to build confidence and gain experience without risking significant capital.

Considerations for Beginners:

- Leverage Use: Leverage can amplify both gains and losses, so beginners should approach it cautiously.

- Risk Management: Beginners should make use of available risk management tools, such as stop-loss and take-profit orders, to limit potential losses.

Evaluation:

Pocket Option is well-suited for beginner forex traders due to its user-centric design, educational resources, and tools that encourage learning and practice. By providing a low-risk environment and access to learning materials, the platform helps new traders gradually build their skills and confidence.

What is the Minimum Deposit for Forex Trading on Pocket Option?

Minimum Deposit Requirement:

To start trading forex on Pocket Option, users are required to make a minimum deposit. The minimum deposit amount is typically $10, making it accessible for most traders, including beginners.

Key Points About the Minimum Deposit:

Low Entry Barrier:

- Description: With a minimum deposit as low as $10, Pocket Option offers one of the most affordable ways for new traders to enter the forex market.

- Benefit: The low deposit requirement makes it easier for beginners to start trading without committing significant capital.

Deposit Methods:

- Description: The platform supports a wide range of deposit methods, including credit/debit cards, e-wallets, cryptocurrencies, and bank transfers.

- Benefit: This flexibility ensures that users can deposit funds using their preferred method.

Account Types:

- Description: Different account types may have varying deposit requirements, depending on the features and benefits associated with each account level.

- Benefit: Users can choose an account type that suits their trading goals and capital availability.

No Hidden Fees on Deposits:

- Description: Pocket Option does not charge hidden fees on deposits.

- Benefit: Users can fund their accounts without worrying about unexpected charges, although bank fees or conversion fees from financial institutions may apply.

Tips for Managing Deposits:

- Start Small: For beginners, it’s recommended to start with a smaller deposit and gradually increase as they gain experience.

- Use the Demo Account First: Before depositing real money, practice with the demo account to build confidence and learn trading basics.

By keeping the minimum deposit low, Pocket Option makes forex trading accessible to a broader range of traders, including beginners who want to start with minimal risk. This approach encourages new users to explore the platform, learn trading strategies, and gradually develop their skills.

How to Contact Pocket Option Support for Forex Trading?

Contacting Pocket Option Support:

Pocket Option provides multiple channels for traders to reach customer support for inquiries related to forex trading or any other issues they encounter on the platform. Here are the available ways to contact their support team:

Live Chat:

- Description: A fast and convenient way to connect with customer support representatives.

- How to Use:

- Navigate to the Pocket Option website or app.

- Click on the “Live Chat” button, usually found in the bottom-right corner of the screen.

- Enter your query and wait for a customer support agent to respond.

- Benefit: This method provides instant responses and real-time assistance, making it ideal for urgent queries or troubleshooting.

Email Support:

- Description: You can send detailed inquiries or documents to the support team via email.

- Contact Email: [email protected]

- How to Use:

- Compose an email with your query, including relevant details such as your account information, trade ID, or any error messages.

- Send the email and wait for a response, typically within 24-48 hours.

- Benefit: Suitable for non-urgent issues or when you need to provide detailed documentation for your case.

Phone Support:

- Description: Call customer support for direct assistance, if available in your region.

- Note: Contact numbers may vary by region, so check the official website for available phone support.

Contact Form:

- Description: Fill out a form on the Pocket Option website with your query, and a representative will get back to you.

- How to Use:

- Go to the “Contact Us” page.

- Fill in the required fields, such as name, email, and a description of the issue.

- Submit the form and wait for a response via email.

Social Media:

- Description: Pocket Option maintains active profiles on social media platforms like Facebook and Twitter, where you can reach out with questions or concerns.

- Benefit: This can be an alternative way to communicate with support if other channels are busy.

FAQs and Help Center:

- Description: The Pocket Option website has a Help Center with answers to common questions and issues related to forex trading, account management, and more.

- Benefit: Quick self-service for frequently encountered issues.

Tips for Effective Support Communication:

- Provide Clear Details: When contacting support, include relevant details like your account number, transaction ID, and a clear description of the issue.

- Be Patient: While live chat is immediate, other channels like email may take longer to respond.

Conclusion

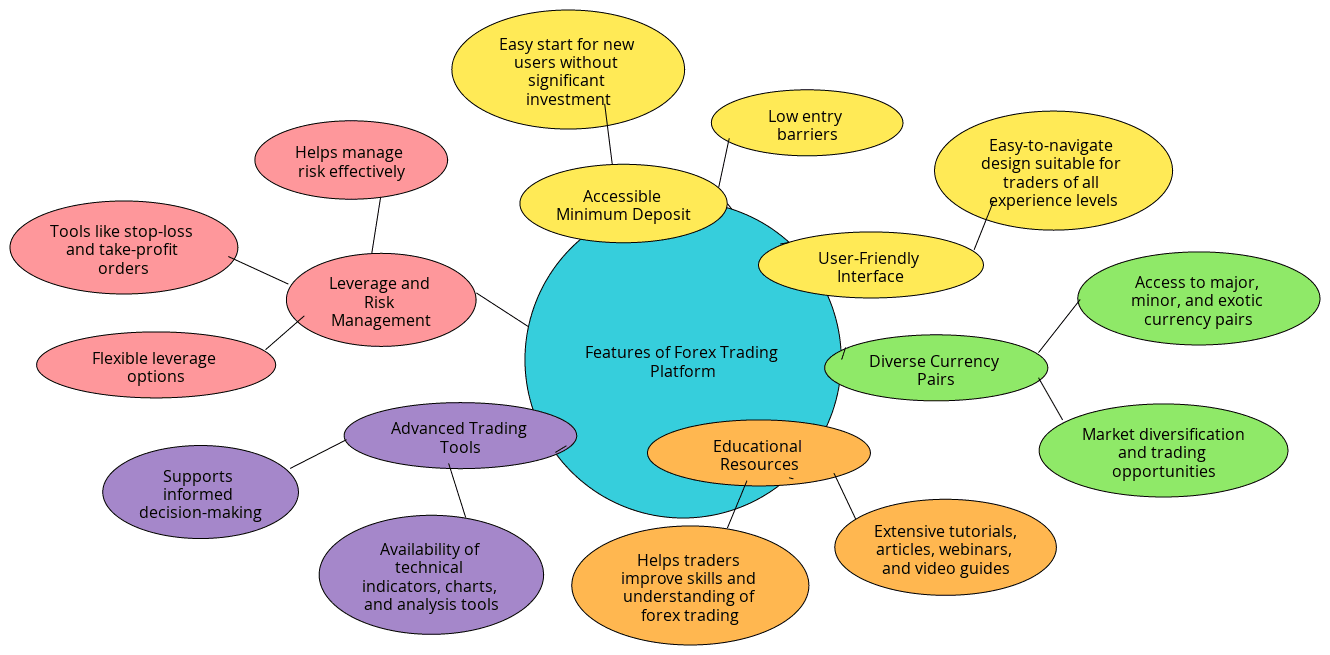

Benefits of Using Pocket Option for Forex Trading:

Pocket Option offers a robust platform for forex trading, making it suitable for both beginners and experienced traders. Key benefits include:

User-Friendly Interface:

- Easy-to-navigate design suitable for traders of all experience levels.

Diverse Currency Pairs:

- Access to major, minor, and exotic currency pairs, allowing for market diversification and various trading opportunities.

Educational Resources:

- Extensive tutorials, articles, webinars, and video guides that help traders improve their skills and understanding of forex trading.

Advanced Trading Tools:

- Availability of technical indicators, charts, and other analysis tools that support informed decision-making.

Leverage and Risk Management:

- Flexible leverage options and tools like stop-loss and take-profit orders help traders manage risk effectively.

Accessible Minimum Deposit:

- Low entry barriers make it easy for new users to start trading without a significant initial investment.

Summary Table:

| Feature | Description |

|---|---|

| User-Friendly Interface | Easy for beginners and experienced traders alike. |

| Currency Pairs | Major, minor, and exotic pairs available. |

| Educational Resources | Tutorials, webinars, and more for skill development. |

| Leverage | Flexible options to maximize trading potential. |

| Risk Management Tools | Stop-loss, take-profit, and more for managing trades. |

| Low Minimum Deposit | Accessible for new traders. |

Links to Authoritative Sources on the Topic:

- Pocket Option Official Website

- Forex Trading Guide (Investopedia)

Reviews of Experts and Users:

- Expert Review: “Pocket Option provides an intuitive platform with essential tools for forex trading, making it a good choice for both novice and seasoned traders.” – Forex Trading Professional

- User Feedback: “I found Pocket Option’s demo account and educational resources extremely useful as a beginner. It gave me the confidence to trade with real money.” – User Review

List of References Used:

Chartered Financial Analyst (CFA): Completed the rigorous CFA program, earning the prestigious CFA designation.

Certified Financial Technician (CFTe): Recognized for his expertise in technical analysis through the CFTe certification.

- Pocket Option Withdrawal Guide for South African Traders - December 8, 2024

- Is Pocket Option Legit in South Africa? - December 8, 2024

- Pocket Option Deposit Methods in South Africa - December 8, 2024

- Pocket Option Review South Africa: Safety, Login,… by Michael Johnson December 8, 2024

- Pocket Option Tanzania: A Complete User Guide by Michael Johnson December 8, 2024

- Pocket Option Promo Codes South Africa: Boost Your… by Michael Johnson December 8, 2024

- Is Pocket Option Legit in South Africa? by Michael Johnson December 8, 2024

- Pocket Option Zimbabwe: Comprehensive Guide to… by Michael Johnson December 8, 2024

- Pocket Option Minimum Deposit in South Africa: A… by Michael Johnson December 8, 2024